Inclusive vs. Exclusive Tax

It is important as a business owner to know what the difference is between inclusive and exclusive taxes and their method of calculation. This is imperative to provide your customers with clear, conscience, and upfront taxes while making sure when it’s time for you to remit your taxes, you are absolutely clear on how they were generated.

In this article, we will go over the following topics:

- Understanding inclusive and exclusive taxes

- When would you use inclusive tax

- When would you use exclusive tax

- How would you use Inclusive and Exclusive taxes on Accrufy

- The default tax behaviour on Accrufy

- Conclusion: Inclusive tax vs Exclusive tax

Understanding Inclusive and Exclusive Taxes

Inclusive and exclusive taxes are 2 different methods of calculating the tax that is applied to a transaction. In both cases, you will be applying the same percentage tax on the transaction, however, the main difference between inclusive and exclusive tax is if you are passing the tax cost down to your customer or if you will be paying for the tax from your price.

For example, let’s say John purchased an item for $ 100.00 and the tax rate for this item is 15%.

With an Inclusive tax, You will charge John a flat $100.00, which would include the 15% tax in it. That means, you are sharing the $100 with your tax authority, that is you are getting $87.00 as your revenue, and the tax-man will receive $13.00

With an exclusive tax, you will be passing the 15% tax cost to John, which means, you will be charging John $115.00 ($100.00+$15.00). Your revenue from this transaction will be the full $100.00 price tag and the customer will pay the taxes.

When would you use Inclusive Tax?

Companies use inclusive tax in these situations (but not only limited to them)

- You want to display the full price to your customer without any surprises

- You are collecting payments in cash and do you want to collect whole numbers (avoid fractions and cents)

- You do not want to calculate taxes while providing services, and prefer to provide easy to remember prices and numbers

- Your competitors are all using inclusive taxes and your general consumer does not expect price changes than what is displayed or promoted.

- etc…

When would you use Exclusive Tax?

Companies use exclusive tax in these situations (but not only limited to them)

- Your country and or region charges exclusive tax by default and your customers are used to it (like the United States and Canada)

- You do not want to reduce your revenue and want to pass the tax price tag to your customer

- You collect payments by card and do not mind price fractions and cents

- You are using a software or system to keep track of your taxes (like Accrufy)

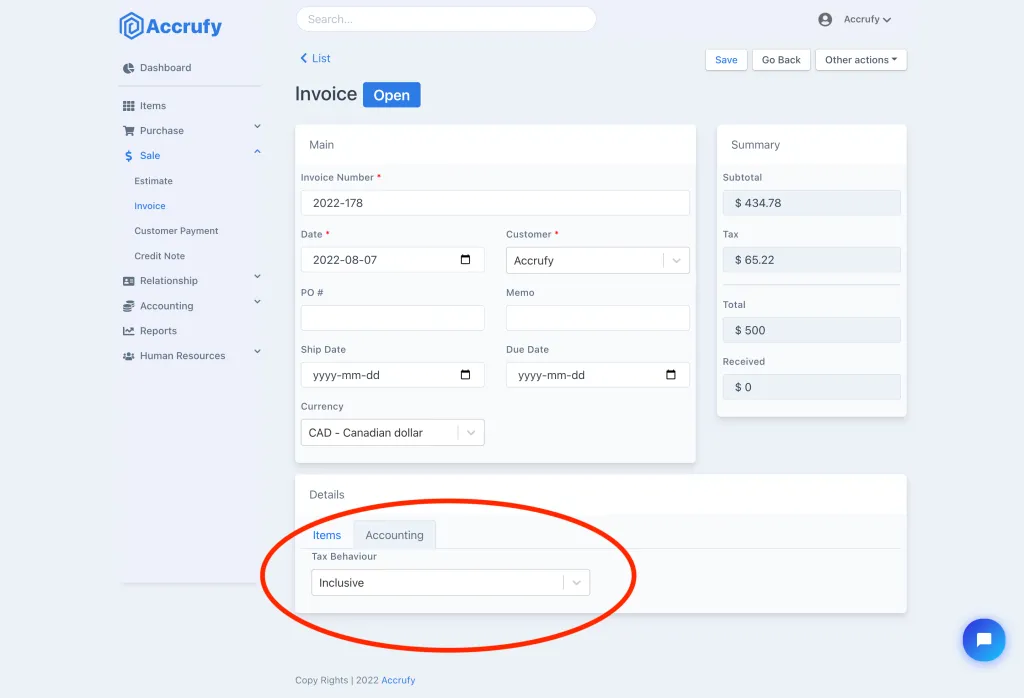

How would you use Inclusive and Exclusive taxes on Accrufy

You can set up the tax behavior on each transaction separately if you wish to do so. This gives you the maximum capability to switch between both tax behaviors with every transaction

Default Tax Behaviour

You can also set up a default tax behavior for your organizations so that it would apply automatically on each transaction. The default tax behavior can still be modified on a transaction-per-transaction basis. However, this would save you time and effort instead of toggling it manually every time

This can be modified in the Settings > Taxes > Default Tax Behaviour here

Conclusion: Inclusive tax vs Exclusive tax

Inclusive taxes are easier to show customers and to account for, they are round whole numbers and represent your full price including your taxes.

Exclusive taxes pass the tax price tag to your customer and could potentially surprise your customers when there receive their invoice if they are not expecting it